DDTLs were used in bespoke arrangements by borrowers who wanted to get incremental committed term loan capacity often for future acquisitions or expansions but wanted to delay the incurrence of the additional debt and thus the additional. Provided that if such date is not a Business Day the Delayed Draw Term Loan Maturity Date will be the next succeeding Business Day.

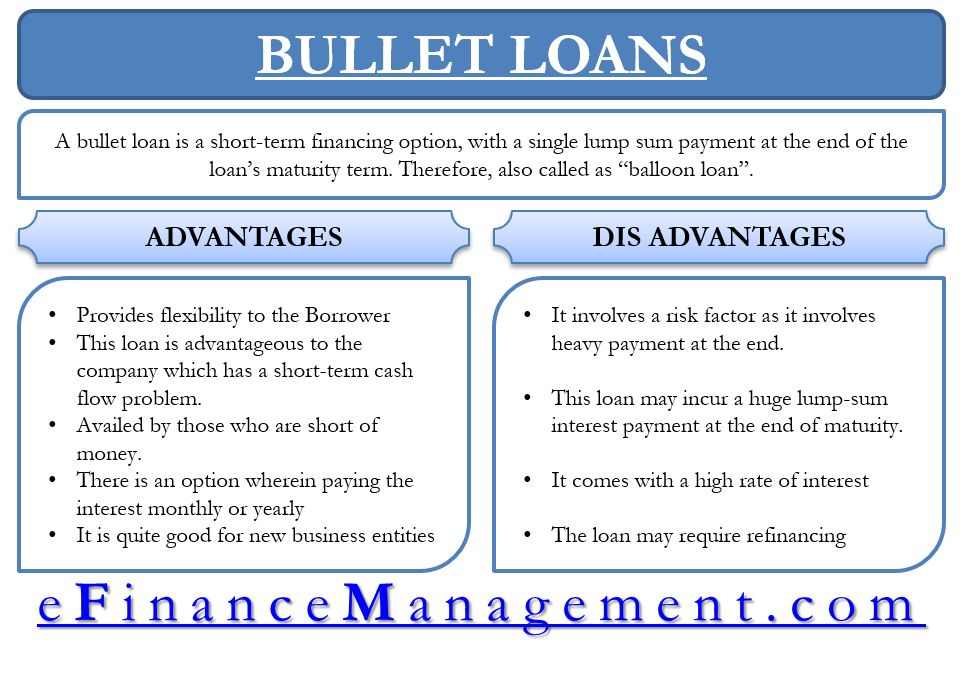

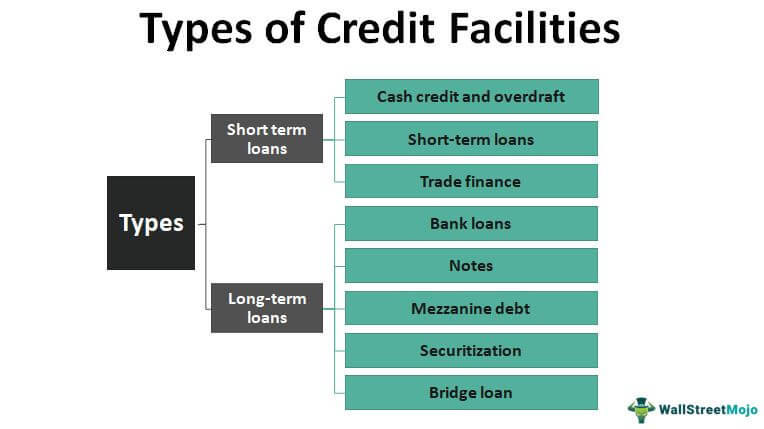

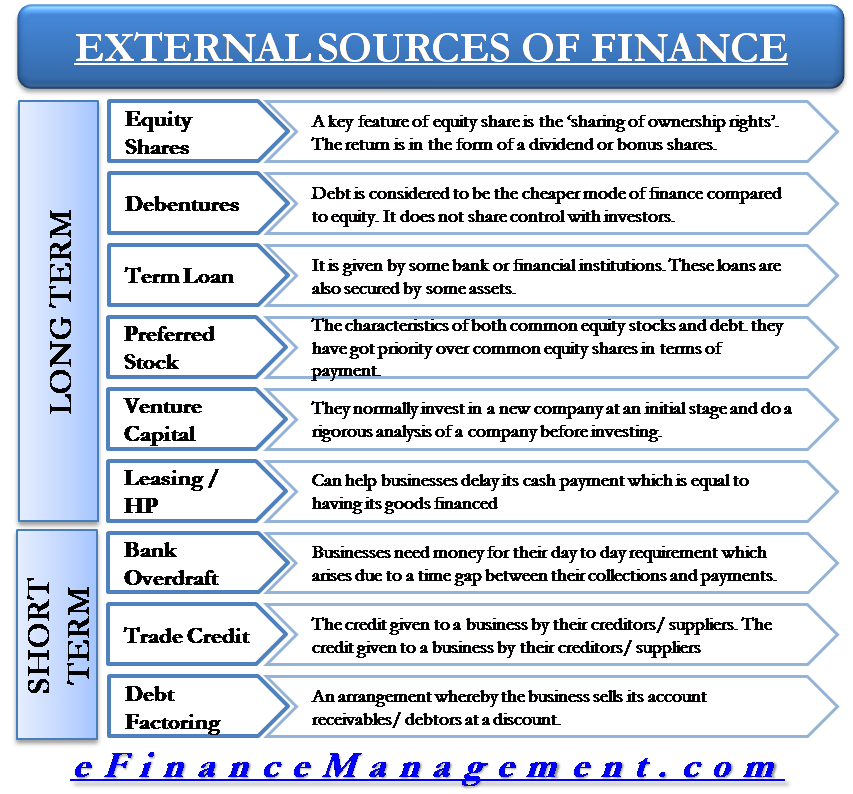

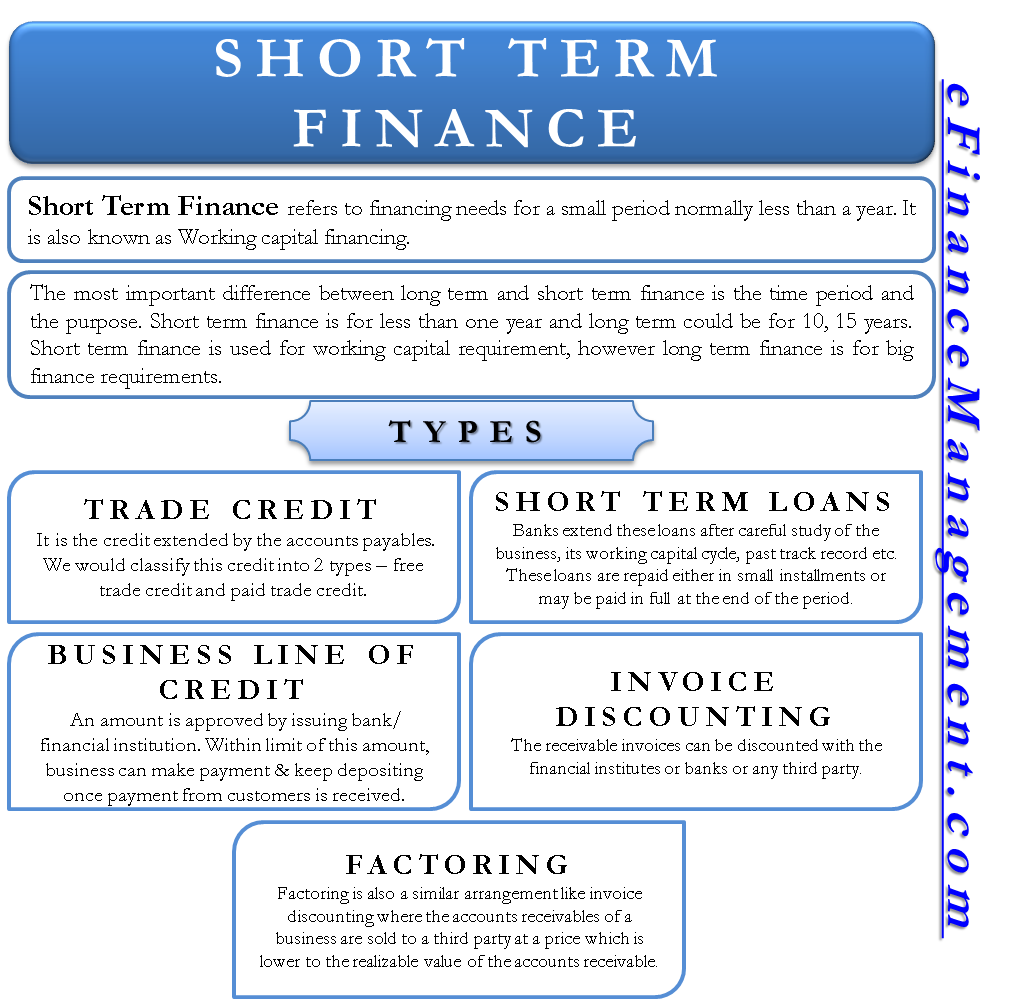

Loans can be short-term or long-term notes.

. A delayed draw term loan also referred to as DDTL is a particular feature of a term loan where the lender disburses pre-approved loan amount based on a pre-determined time schedule. Provided that any Loan as to which no further. The accordion feature is an added.

Unless the context requires otherwise i any definition of or reference to any agreement instrument or other document herein shall be construed as referring to such. For example you can have loan withdrawals taking place every three months or six months or at other intervals agreed by the lending institution. Thuật ngữ tương tự - liên quan.

Delayed Draw Term Loan means any Loan that is fully committed on the initial funding date of such Loan and is required to be fully funded in one or more installments on draw dates to occur within one year of the initial funding of such Loan but which once such installments have been made has the characteristics of a term loan. 1 TO DELAYED DRAW TERM LOAN CREDIT AGREEMENT dated as of April 23 2021 this Amendment is entered into among Walgreens Boots Alliance Inc a Delaware corporation the Borrower the Lenders as defined below party hereto and Wells Fargo. 137500000 DELAYED DRAW TERM LOAN FACILITY Table of Contents Page.

DELAYED DRAW TERM LOAN CREDIT AGREEMENT. Delayed Draw Term Loan Definition là gì. That means the borrower doesnt have to pay them from personal funds while.

Danh sách các thuật ngữ liên quan Delayed Draw Term Loan Definition. This Credit Agreement dated as of August 31 2012 is among Par Petroleum Corporation a Delaware corporation Borrower the Guarantors party hereto from time to time together with the Borrower each a Credit Party and collectively the Credit Parties the lenders party hereto from time to time the Lenders and. An accordion feature in a line of credit allows a business to increase that line of credit if necessary often to obtain more working capital or emergency cash.

Delayed Draw Term Loan A Loan that is fully committed on the closing date thereof and is required by its terms to be fully funded in one or more installments on draw dates to occur within three years after the closing date thereof but which once fully funded has the characteristics of a. Delayed Draw Term Loan Maturity Date means the date that is seven years after the Closing Date. But loan terms can also refer to the features of a loan that you agree to when you sign the contract.

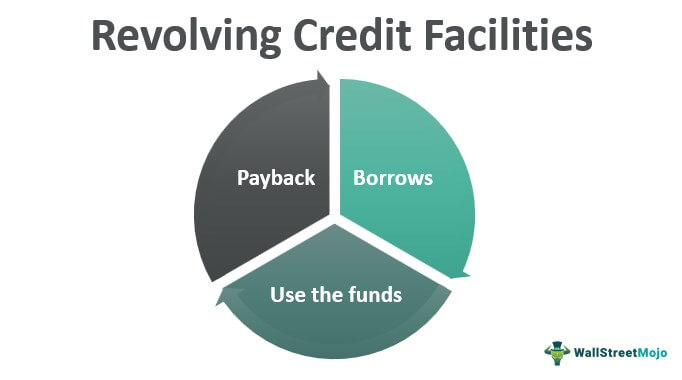

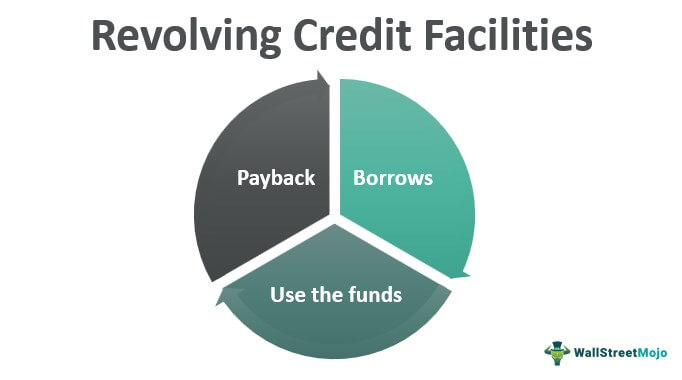

More Definitions of Delayed Draw Term Loan Availability Period. A revolving loan comes with a replenishing feature where the borrower can withdraw amounts and repay to fully utilize the facility again. A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times.

Their appeal is one reason borrowers have moved toward the private debt market sometimes at the expense of syndicated loans. Delayed Draw Term Loan Availability Period means with respect to the Delayed Draw Term Loan Commitments the period from and including the first 1st Business Day immediately following the Closing Date to the earliest of a the Term Loan Maturity Date b twenty-four 24 months following the. The lenders approve the term loans once with a maximum credit limit and charge variable interests on them.

Refers to the loans that the Lender has agreed to be made available to the Borrower under a Revolving Credit Facility or a Delayed Draw Term Facility that the Borrower has either not drawn or has drawn and repaid. Delayed-draw term loans or DDTLs of up to two years are standard features of financing from private credit providers. 1 TO DELAYED DRAW TERM LOAN CREDIT AGREEMENT.

Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. Delayed disbursement is a cash management technique that involves using checks drawn on banks in remote areas to deliberately slow down payments. ARTICLE I DEFINITIONS AND ACCOUNTING TERMS.

A loan term is the length of time it will take for a loan to be completely paid off when the borrower is making regular payments. Delayed Draw Term Loan Definition là Trì hoãn Draw vay Term Definition. The revolving loans are approved for the short-term usually up to one year.

A draw is a payment taken from construction loan proceeds made to material suppliers contractors and subcontractors. May consist of immediately funded or delayed-draw term loans or of revolving credit commitments May be implemented as either a new credit facility or as an upsizing of an existing credit facility May be implemented via an amendment agreement an incremental assumption agreement or an amendment and restatement of the existing credit. 124 Delayed draw debt A reporting entity may enter into an agreement with a lender that allows the reporting entity to delay the funding of its debt provided it is drawn within a specified time period ie the reporting entity gets to choose the date that the debt funds within a.

The time it takes to eliminate the debt is a loans term. Đây là thuật ngữ được sử dụng trong lĩnh vực Ngân hàng Khái niệm cho vay cơ bản.

Loan Structure Overview Components Examples

Delayed Draw Term Loans Financial Edge

Bullet Loan Efinancemanagement

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

Types Or Classification Of Bank Term Loan And Features Lopol Org

Revolving Credit Facilities Definition Examples How It Works

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Types Of Credit Facilities Short Term And Long Term

External Sources Of Finance Capital

:max_bytes(150000):strip_icc()/dotdash-whats-difference-between-grace-period-and-deferment-Final-f578b305f5764f19bce7046a690b71e0.jpg)

Grace Period Vs Deferment What S The Difference

Revolving Credit Facility Efinancemanagement

Long Term Debt Types Benefits Disadvantages And More Money Management Advice Personal Finance Advice Personal Finance Organization

The Benefits Of Long Term Vs Short Term Financing

Financing Fees Deferred Capitalized Amortized

Short Term Finance Types Sources Vs Long Term Efinancemanagement

Delayed Draw Term Loan Ddtl Overview Structure Benefits

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)